In particular we focus on getting the loan structure right the first time, choosing which lenders to use in the right order (yes this is important) and finally getting our clients the best deal possible.

RBA cash rate predictions

RBA Cash Rate Predictions

Trying to predict where the RBA cash rate will be in 1-, 6- or 12-months’ time seems to be an Australian pastime a bit like property itself. The expression “opinions are like a**holes everyone has one” comes to mind!

We do get asked this almost daily though so here goes nothing.

Mortgage Experts Prediction:

2.60% pa by November then flat for foreseeable future.

As we have been telling everyone who will listen 2 of the major banks (CBA and Nab) haven’t even passed on the rate increases we have had so far so I expect a big slowdown in the wider economy once they fully kick in. Those two lenders account for almost 40% of the entire mortgage market!

If the cash rate hits 2.60% then a well-priced home loan would end up about 4.40% - 4.60% pa.

Major Bank Economist Predictions:

Lowest 2.60% (CBA), highest 3.35% (ANZ and Westpac).

Nab sits in the middle at 2.85%. All are predicting rates to peak towards the end of the year, early next and then to decrease a little in mid to late 2023.

Crazy Outlier Predictions:

We couldn’t really find any crazy predictions like 10% etc. I did read one article saying if inflation is at 8% in the US then their cash rate would have to be 10% to stamp out inflation but this was from a real estate agent so they should probably just stick to selling houses.

Bond yields and 4-year fixed rates at 4.99% pa

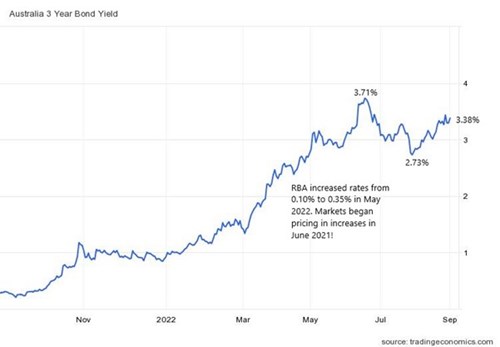

Fixed rates are very much influenced by the cost of money that is bought and sold in the money markets. In the 3-year bond yield chart below notice the dip in bond yields last month (August 2022). This set off a mini wave of discounting in the fixed rate market which was nice to see after months of relentless increases!

There are a few offers at 4.99% for 3 or 4 years fixed (owner occupied and P&I repayments). While this sounds high compared to what was on offer earlier in the year (1.99% anyone?) they may prove to be good value if the RBA cash rate ends up above 3% as some experts are predicting (see above). Lenders typically add about 1.80-2.00% margin to the cash rate so home loan rates would end up at more than 5% if the cash rate gets above 3%.

Note also above the yields are on the up again and the 3-year bond yield at the time of writing sits at 3.38% implying home loan rates will be 5.38% or so in a few years’ time. The takeaway from that is those special fixed rates on offer at 4.99% may not last much longer.

Recent Posts

- The “Housing Crisis” and Capital Gains Tax (CGT) changes? Thoughts…

- Is now the time to access equity? APRA changes coming + Interest rate outlook

- Government Guarantee Scheme – an update on the changes from 1st October 2025

- Limited Deposit and don’t qualify for the government guarantee scheme? Up to 100% LVR loans available

- Government grants and schemes - to help you into the market

- Is Darwin property about to go Boom?

- Comparing interest rates (Western Democracies)

- Stage 3 Tax cuts - how will it effect your borrowing capacity?

- Property Share Loan Structure

- SMSF Property Investing & Lending - Back on the agenda