In particular we focus on getting the loan structure right the first time, choosing which lenders to use in the right order (yes this is important) and finally getting our clients the best deal possible.

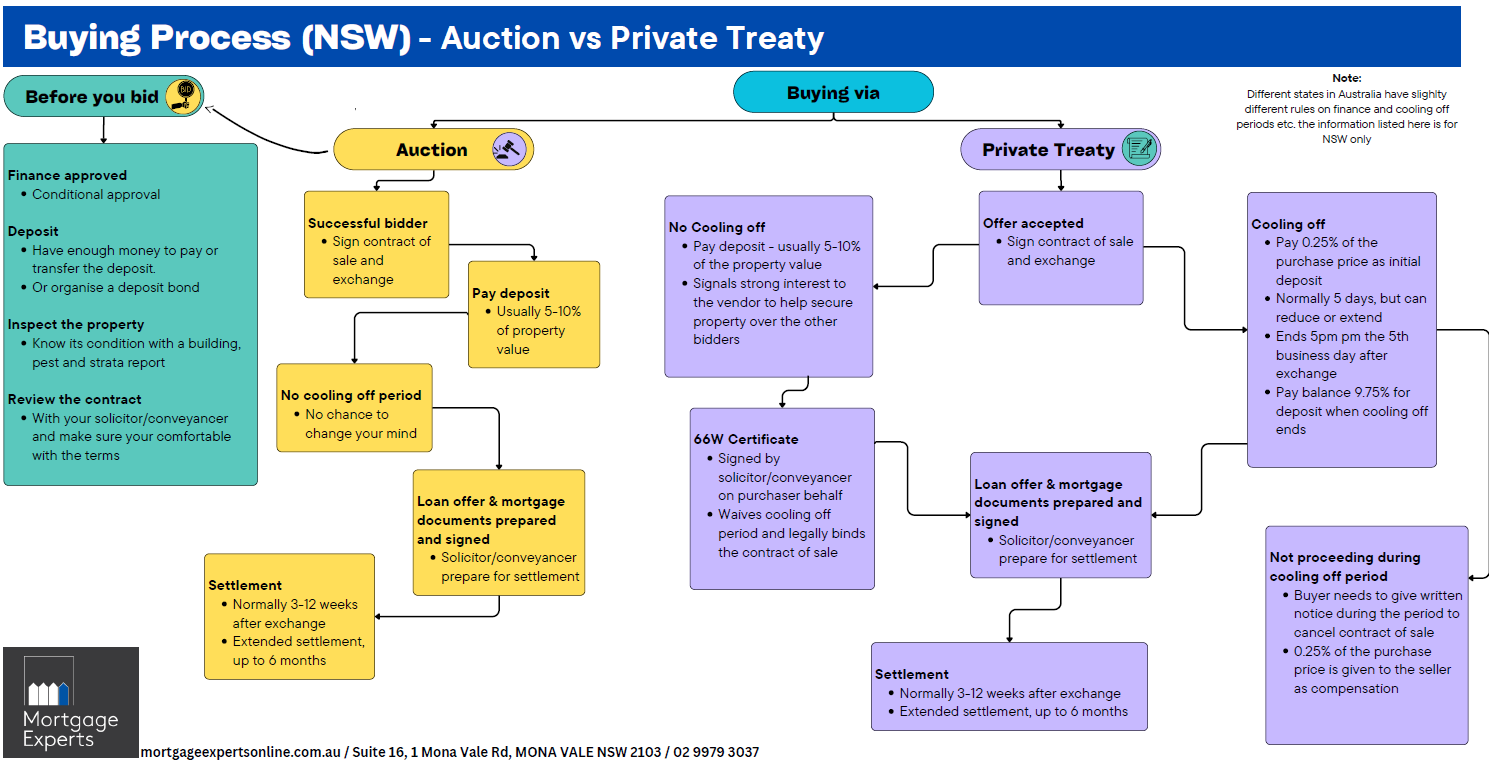

BUYING PROCESS - PRE AUCTION / AUCTION / PRIVATE TREATY

What does a Pre auction offer mean

Properties listed for auction can often sell beforehand. You can make an offer on a property before the auction and if accepted the contracts can be quickly exchanged and the auction cancelled. This is called a pre auction offer. This may suit both purchaser and vendor for a number of reasons but most commonly for the purchaser it takes the property off the market and for the vendor it allays their concerns about their property not selling on the day. The vendor may also be looking at other properties to buy at the same time and an exchanged contract means they can move forward with their purchase plans. In a market that is cooling often vendors will not want to risk a failed auction and will be happy to consider pre auction offers. Conversely in a hot market most vendors would prefer to just see what happens at the auction.

Pre Auction Offer Process - Tips

If you do want to make a pre auction offer (noting that it will be under auction conditions with no cooling off or subject to finance clauses) make a realistic offer but under your maximum bid and always put your offer in writing with your preferred settlement time frame. If the vendor comes back asking for an increased offer – and they will! – we recommend you up your offer slightly and advise them that that is your final pre auction offer. If you get no response from the agent or vendor do not contact them again. If they contact you just before the auction which you would expect, tell them you may or may not be bidding (and mean it). You may then be able to get a gauge where you truly stand by their reaction ie. how desperate are they for you to attend the auction?

A tactic that some buyers use is to offer the vendor / agent a time ultimatum on their offer, you would say to the agent that your offer is valid only for a certain time. This can be vital if you are interested in more than one property at the same time. It can smack a touch of desperation though so we would advise you leave the door open for further negotiations by saying something like I need an answer from the vendor by COB Friday because I want to bid on another property on Saturday.

In general we are against pre auction offers in a hot market as they tend to show your hand and they give the agent an unfair advantage in knowing how they will navigate the sales process. For example if the agent gets multiple pre auction offers then they are likely to think that the auction will be a success and therefore may not accept your pre auction offer....unless you fall into the trap of offering more than they think they will get at auction! This is the other concern we have with pre auction offers as they tend to end up causing bidders to pay too much as in a hot market the agent will only accept a pre auction offer if it is particularly strong.

Want some advice on Pre Auction offers? Contact us here

Mortgage Experts are mortgage brokers on Sydney's Northern Beaches.

We can assist with your loan needs and we can also pass on our considerable experience when it comes to dealing with auctions / pre auction offers and private treaty sales.

We have been involved in literally thousands of purchase transactions and we take a keen interest in the varying negotiating tactics of our clients. Over time we have picked up some tips that we think can be useful for those looking to buy which we have outlined below. If you would like to discuss your loan needs please feel free to

Tips for Auction Sales:

The auction process can be stressful. It is important to understand that if your bid is successful at an auction, you are exchanging contracts on the day with no recourse if you change your mind. You can not pull out of the purchase.

Some key things to consider if you want to bid at auction are:

Pre approval

You must get a “real” pre approval before the auction. This means that your loan application has actually been properly assessed and approved, subject only to a property valuation. Incredibly, many lenders will not do this as they see doing pre approvals as a waste of resources as many do not proceed. At Mortgage Experts we can make sure you get a real pre approval so you are as safe as you can be with an auction.

Setting your limit

You must set your limit before the auction and stick to it! A good idea is to pick a rough number as your limit. Say you are approved to buy up to say $1,200,000 but you don’t want to quite go that high you could make your limit say $1,182,000. You may be lucky and knock out a few other buyers with limits of $1,175,000 or $1,180,000 for example.

Don’t take the agent’s price guide seriously

Although intentional under-quoting of the expected sale price is illegal in some states and certainly unethical, it is still rife. It is extremely common for properties to go for around 10% - 20% more than the price guide offered. So real estate agents are either very bad at knowing the value of a property or they are trying to suck in as many potential buyers as possible before the auction to get them emotionally attached to the property. The moral of the story is you must get a gauge on what properties are worth yourself. Attend multiple auctions, research past sales, research the property itself to see what it last sold for and compare that to the median price increase in the area (allow for any renovations).

Negotiate any changes to the contract before auction

The contract for sale will outline the inclusions of the property as well as the settlement time frame. This can be negotiated but must be done before the auction. The vendor is not obliged to change their contract but may be willing to do so.

Tips for Private Treaty Sales:

The private treaty method of buying your first home is a bit less stressful than buying at auction – especially if you are buying your first home. Normally a private treaty sale will be handled by a real estate agent, but it can also be done directly by the owners. Buying via private treaty means you shouldn't have to exchange contracts unconditionally until you have a formal loan approval.

Keep your cards close to your chest

Do express an interest to the agent handling the sale, or the vendor if it’s a private sale, but try not to show too much emotion. If possible also let them know you are interested in other properties. Don’t disclose your finance position. Often agents will ask “have you got your finance sorted” or “do you have a 10% deposit available”. They are really just fishing for information and we advise to not disclose this information or to be vague in your answers. Don’t be rude to them, just divert the questions! Asking them what price the vendor wants usually works!

Do your homework

Find out how much other properties in the area have sold for recently (not what they are for sale for, this doesn't tell you much). Go to auctions and learn as much as you can about local property market trends. You can even collect your own clearance rate stats by checking how many of the properties listed for auction on a given weekend in your area have sold stickers on their billboards by early the following week. If more than 75% have sold this would be considered a buoyant market, if it’s less than 50% it would be considered a slow market.

Go in low but not too low

When you make an offer, pitch it below the price you’re actually prepared to pay. Very few properties sell for the price initially offered. Market conditions will obviously have a bearing on this, in a buyers market by all means put in low offers but in a normal or buoyant market you will be more than likely be wasting your time. Again knowing the true value of the property by doing your research is the key.

Don’t believe a word the Agent says!

However nice an agent may seem (and they may be) you must remember that it's their job to secure a sale and to get a good price for the vendor. Many agents are very good negotiators and are generally going to be at an advantage to a home buyer who is not as experienced in real estate and negotiations in general as they are. Often an agent will say there’s a higher offer on the table than the one you’ve just made or there is a lot of interest in the property. While this may be true don’t take it as gospel, just stick to your limit and negotiate up to that. You really can't rely on what they say! Don’t get duped into bidding against yourself or get pressured into exchanging contracts without your finance in place.

Put your offer in writing

Real estate agents are obliged to submit all offers to the seller, so we recommend that you submit your offer in writing. Remember your offer once accepted is not legally binding until you and the vendor sign the contract.

Negotiate changes to the contract upfront

If you want a special condition such as a long settlement, make this known upfront. It is no good agreeing on a price only to discover the vendor needs a quick settlement. Negotiating is not just the price but the settlement time frame and what is included in the sale.

Buying your first home or upgrading? Call the Mortgage Experts!

Our Current Lender Panel