In particular we focus on getting the loan structure right the first time, choosing which lenders to use in the right order (yes this is important) and finally getting our clients the best deal possible.

Property Share Loan Structure

Did you know there is a way to buy a property with family or close friends without having to be joint borrowers? We call this “Property Share” or “Property Share Loan Structure”. It allows people to borrow independently of each other to achieve joint property ownership.

The issue traditionally with buying with family or friends has been the loan required would be “joint and severally liable” meaning each borrower was effectively liable for the whole debt if the other borrowers couldn’t meet repayments. There are a few lenders out there who have policies in place that allow friends, family, even flat mates etc. to get into the property market by pooling their resources without having to be jointly liable for shared debts.

With Property Share each applicant can have separate loans. This gives the financial freedom to allow each party to manage their own loans and the ability to borrow in the future based on just their own debts rather than being assessed on the proposed new debt and existing joint debts with other parties.

Each lender has rules on how many applications and applicants there are allowed to be. Each applicant needs to have a substantial ‘benefit’ and be listed on the title, the share needs to be a minimum of 20-30% depending on lender. Not all owners have to be borrowers in this scenario either so it can be popular with children and parents buying together.

Property Share and Guarantees

It must be pointed out that with Property Share that although multiple owners of a property can borrow separately from each other you can’t sell half or a third of a house, so all borrowers have to guarantee each other’s loans. In practice this means that if one set of borrower’s default on their loan the lender can force the sale of the property to recover their funds. The distinction here is this is a security guarantee only not a full guarantee meaning the other borrowers are not liable for the other parties loans in this scenario.

Property Share Example 1: Couple + Friend:

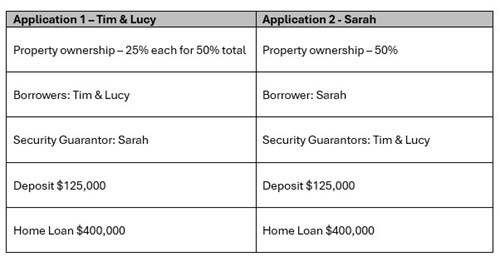

A couple (Tim & Lucy) and their good friend (Sarah) want to buy a property together with the couple to own a 25% share of the property each (50% total) and Sarah to own the other 50%.

The property is worth $1,000,000 and they want to borrow in total $800,000 i.e. 80% of the property value but as two separate $400,000 loans each.

They are also contributing equal deposit amounts of $125,000 each to cover the 20% + all costs.

Below is what this would look like in a Property Share structure.

Property Share Example 2: Couple + Parent:

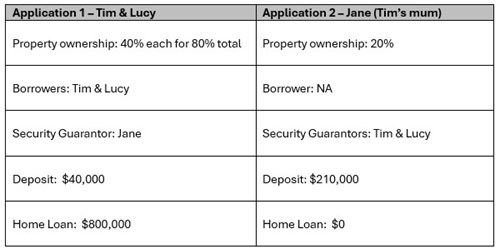

A couple (Tim & Lucy) and Tim’s mum (Jane) want to buy a property together to all live in. The couple will own a 40% share of the property each (80% total) and Jane will own the other 20%.

Tim and Lucy have a good incomes but not much deposit while Tim’s mum has a lower income but a large amount of savings. Jane does not want to borrow money as she is planning to retire in the next few years.

The property being purchased is $1,000,000 and they intend to borrow 80% of the value i.e. $800,000 with the balance of the purchase price of $200,000 to be funded with savings and $50,000 allowed for to cover stamp duty and legal fees.

Below is what this could look like in a Property Share structure.

The “Property share” loan structure can be used for Owner Occupied and investment property purchases. If you’re already on title you can also get loans for home renovation/consolidation of debt/personal investment as long as you agree to guarantee each other’s loans.

You can’t use property share loans for business matters, bridging loans, purchasing land, building or construction loans.

If you are interested in buying with a friend or family member, reach out to us to run the numbers and discuss the pros and cons.

Recent Posts

- The “Housing Crisis” and Capital Gains Tax (CGT) changes? Thoughts…

- Is now the time to access equity? APRA changes coming + Interest rate outlook

- Government Guarantee Scheme – an update on the changes from 1st October 2025

- Limited Deposit and don’t qualify for the government guarantee scheme? Up to 100% LVR loans available

- Government grants and schemes - to help you into the market

- Is Darwin property about to go Boom?

- Comparing interest rates (Western Democracies)

- Stage 3 Tax cuts - how will it effect your borrowing capacity?

- Property Share Loan Structure

- SMSF Property Investing & Lending - Back on the agenda