In particular we focus on getting the loan structure right the first time, choosing which lenders to use in the right order (yes this is important) and finally getting our clients the best deal possible.

Interest rates! Where to from here?

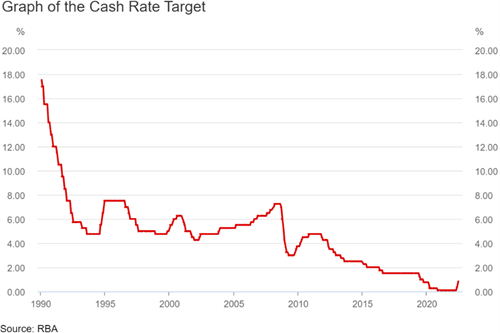

While most observers were expecting the RBA to move on Tuesday the 0.50% pa increase (new RBA overnight cash rate 0.85% pa) felt a little shocking.

We feel the RBA has been almost criminally slow to react to emerging inflation which was obvious to the money market from about December 2021 onwards. Their “promise” to the general public that rates would not increase until late 2023 left a lot of people with a false sense of security and now no doubt a feeling of dread. The RBA have lost a lot of credibility.

So where are we headed now? The RBA is behind the curve so to speak so we can expect a few more aggressive rate increases in the next few months. Then hopefully a pause so they can gauge the effects on the economy.

We are thinking the cash rate will peak at around 2.00% which is below what many economists are predicting. Those same economists also thought house prices would crash in the pandemic. A cash rate of 2.00% would mean a competitive home loan rate would be about 4.25% - 4.50% pa and investment loans would be about 4.75% -5.00% pa.

We don’t think they will need to go any higher than around 2.00% cash rate to put the brakes on the economy. Don’t forget the cash rate pre the pandemic was 1.50% pa and falling as the economy was subdued and inflation non-existent. This is to say that once China opens up again and the world adjusts to the Ukraine-induced shortages then inflation will subside.

Regarding property prices, we think prices coming off 10% -15% or so over the next 2 years is the likely scenario (a return to mid-2021 prices in most areas). The froth has already disappeared in the Sydney, Melbourne, and Canberra markets and much of this may already be in play. If inflation does become endemic don’t forget that this will eat away at the real levels of debt people have, so in the long run a little inflation may be a good thing.

Recent Posts

- The “Housing Crisis” and Capital Gains Tax (CGT) changes? Thoughts…

- Is now the time to access equity? APRA changes coming + Interest rate outlook

- Government Guarantee Scheme – an update on the changes from 1st October 2025

- Limited Deposit and don’t qualify for the government guarantee scheme? Up to 100% LVR loans available

- Government grants and schemes - to help you into the market

- Is Darwin property about to go Boom?

- Comparing interest rates (Western Democracies)

- Stage 3 Tax cuts - how will it effect your borrowing capacity?

- Property Share Loan Structure

- SMSF Property Investing & Lending - Back on the agenda