In particular we focus on getting the loan structure right the first time, choosing which lenders to use in the right order (yes this is important) and finally getting our clients the best deal possible.

What is a credit score? And how does it affect me applying for a home loan?

Understanding your credit score

Did you know that having a good ‘Credit Score’ is an integral part of being successful in getting a home loan? Each lender has their own way of determining a borrower’s credit score. While some use scoring as a guide some others will automatically decline a loan if your score is below their threshold. Ouch. This can come as a rude shock.

There is some confusion around what a credit score / credit scoring really is. Unlike in the USA, for example, your credit score is not really (yet anyway) a universally accepted number that determines which lenders will deal with you and what interest rates you get offered. In Australia most lenders use their own internal credit scoring system which incorporates both their intelligence, and one or more of the official Credit Reporting bodies’ ‘Credit scores’.

There are 3 official credit reporting bodies, Equifax, Experian and Illion. We typically use Equifax as this seems to be the one the lenders use most. It would be possible (but rare) to have a high credit score with one of the reporting bodies and still be declined by a lender on credit scoring grounds.

A “credit score” from a credit reporting body is based on a range of factors including: default and bankruptcy history, repayment histories for past and current loans and credit cards, the amount of enquiries for credit a person has made in the last 5 years, the amount of enquiries in the last 3 months, last month etc and the types of credit applied for. Payday loans, for example, would have a seriously negative impact on a credit score. Multiple applications in quick successions also have a negative impact on scores. Then there are other more controversial factors like a person’s age and postcode where they live and work which also feed into their credit score.

A credit score from a lender would generally incorporate the above plus other factors such as the proposed loan to value ratio, the borrower’s occupation, employment history, address stability and a partner’s details if borrowing jointly. As an example, Macquarie Bank has advised us that their credit scoring engine uses 99 separate data points to determine a credit score. This is before they even assess borrowing capacity! Most lenders guard their credit scoring algorithms very closely so they cannot be manipulated.

Let’s look at the information in your credit file

Firstly, a file will list your full name and cross reference with previous names (ie. If you have been married). It tells you your date of birth, your last known address as well as how old your report is. If you’re on the younger side your credit report may show little or no data.

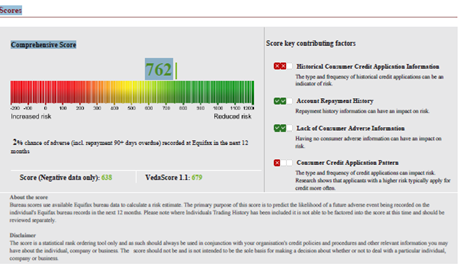

Next it will show you on a graph what your score is. At this stage you will be hoping you’re in the ‘green’ section which shows you have a ‘reduced risk’ for lending and not in the ‘red’ zone which is an immediate red flag for lenders that you have an ‘increased risk’ that you may not be suitable to lend to.

A credit score of under 500 can be enough to cause an automatic decline with some lenders. Between 500 and 600 is considered pretty low and will likely cause some issues with some lenders. Between 600 – 700 is average. Between 700 – 800 is a decent score and is unlikely to present issues. 800 + is excellent and so will not result in any credit scoring issues.

Figure 1 Sample Report Only

Also included

- A section that has some ‘key contributing factors’ that effect your score. Historical consumer credit application information, your account repayment history, lack of consumer adverse information and consumer credit application pattern. A lender will look at all these as well to determine if you’re going to be a strong candidate to lend money to

- A list of all credit enquiries / applications for credit over the last 5 years. Details include who the enquiry was with, the account type ie. If it was for a home loan, credit card or even telecommunication service etc, the amount applied for and if it is a sole or joint account

- Details about current and previous business relationships including directorships and business names held

Repayment History

Your report will list each loan / credit facility separately with the lenders name, account number, the open date, if it’s still open or if it is closed, the latest limit, original limit and then your repayment history. It will have monthly transaction history for the past 2 years indicated by way of the following codes:

|

Code |

Description |

|

0 |

Repayment made in time |

|

1 |

1 late payment (at least 14 days late) |

|

2 |

2 consecutive monthly payments missed |

|

3 |

3 consecutive monthly payments missed |

|

4 |

4 consecutive monthly payments missed |

|

5 |

5 consecutive monthly payments missed |

|

6 |

6 consecutive monthly payments missed |

|

X |

More than 6 monthly payments missed |

|

R |

Not reported for this period |

|

P |

Pending (waiting for report) |

|

C |

Account closed |

If you pay your credit card late, for example, each month but you do make the minimum repayment every month you would have a series of “1’s” noted on your file. Whereas if you failed to make a payment for 2 months then it would show as a “2” which is lot more serious.

At the end of the day lenders have more information available to them about your personal finances and how you behave financially than ever before. So, paying bill and loans on time has never been more important.

What if my credit score is bad? How can I fix it?

If your score is low, you can generally increase it by

- paying bills and loans on time

- not applying for certain types of credit for e.g. BNPL or pay day loans

- not applying for any credit for a period

There are also credit repair companies that specialise in removing adverse reporting on your credit file for e.g. a default. They can sometimes remove these if due procedure was not followed by the lender.

Can I dispute a record on my credit file?

Yes, you can start by calling up the financial institution and discussing it with them. It may be a system error where a ‘cross reference’ has been accidently put on your account, they have duplicated the debt, or it could be something more sinister like identity fraud. You can also contact one or all of the credit reporting bodies who have processes in place to fix errors.

Where can I get a copy of my Credit File Report

https://www.equifax.com.au/personal/products/equifax-credit-report

Recent Posts

- Is now the time to access equity? APRA changes coming + Interest rate outlook

- Government Guarantee Scheme – an update on the changes from 1st October 2025

- Limited Deposit and don’t qualify for the government guarantee scheme? Up to 100% LVR loans available

- Government grants and schemes - to help you into the market

- Is Darwin property about to go Boom?

- Comparing interest rates (Western Democracies)

- Stage 3 Tax cuts - how will it effect your borrowing capacity?

- Property Share Loan Structure

- SMSF Property Investing & Lending - Back on the agenda

- Could the next move in interest rates be down?