In particular we focus on getting the loan structure right the first time, choosing which lenders to use in the right order (yes this is important) and finally getting our clients the best deal possible.

The 2016 Wrap up: Can it keep going?

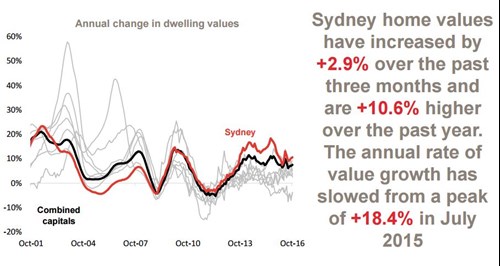

While there was a slight decline in prices at the beginning of the year, the Sydney property market will end up with double digit growth again this year. This rise has been attributed to a strong economy, large population growth of around 1,100 new arrivals a week, increased demand from family’s looking to upgrade and the demand from investors chasing capital growth.

In 2016 Australian property markets experienced historically low interest rates and a patchy economy, strong in Sydney and Melbourne and weak elsewhere especially WA and rural Victoria. As such the property market is fragmented, driven by local factors such as job and population growth and supply and demand.

Looking forward, it’s likely Sydney and Melbourne property markets will outperform other areas again. There is continuing demand from investors and home owners with a distinct lack of supply of free standing properties located within the middle rings of both cities. 57% of Australia’s population live in New South Wales and Victoria and these two states account for 54% of economic activity.

Next year’s property market in Sydney is all about what happens with interest rates. Lenders have already this week lifted some rates and I expect that to continue in 2017. If the RBA moves up next year that will be a signal to the market that rates bottomed in 2016 and that the party is over. Our prediction however is that there will be no change from the RBA. Lenders though will increase both owner occupied and investment loan rates over the next 12 months by around 0.4% pa. Investment rates will rise by a larger degree with the spread between the two ending up at a 0.50%-0.75% pa differential. With that in mind we predict a 5% increase in property prices in 2017 in Sydney.

Recent Posts

- Is now the time to access equity? APRA changes coming + Interest rate outlook

- Government Guarantee Scheme – an update on the changes from 1st October 2025

- Limited Deposit and don’t qualify for the government guarantee scheme? Up to 100% LVR loans available

- Government grants and schemes - to help you into the market

- Is Darwin property about to go Boom?

- Comparing interest rates (Western Democracies)

- Stage 3 Tax cuts - how will it effect your borrowing capacity?

- Property Share Loan Structure

- SMSF Property Investing & Lending - Back on the agenda

- Could the next move in interest rates be down?