In particular we focus on getting the loan structure right the first time, choosing which lenders to use in the right order (yes this is important) and finally getting our clients the best deal possible.

Case Study: Common Debts with Family Members

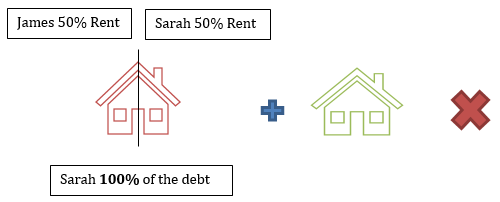

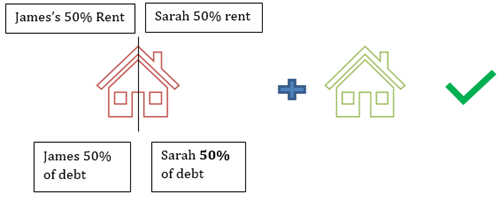

We found a lender for Sarah that had a Common Debt Reducer Policy. This meant that if we could show that her brother was self-supporting and that he could manage paying his half of the investment loan repayments then they would take just 50% of the existing loan into account for Sarah. She would need to show she could service the new loan in her own right and half of the existing loan.

Recent Posts

- Is now the time to access equity? APRA changes coming + Interest rate outlook

- Government Guarantee Scheme – an update on the changes from 1st October 2025

- Limited Deposit and don’t qualify for the government guarantee scheme? Up to 100% LVR loans available

- Government grants and schemes - to help you into the market

- Is Darwin property about to go Boom?

- Comparing interest rates (Western Democracies)

- Stage 3 Tax cuts - how will it effect your borrowing capacity?

- Property Share Loan Structure

- SMSF Property Investing & Lending - Back on the agenda

- Could the next move in interest rates be down?