In particular we focus on getting the loan structure right the first time, choosing which lenders to use in the right order (yes this is important) and finally getting our clients the best deal possible.

5 Year Fixed Rate

Which lender has the lowest 5 year fixed rate loan?

If it was as simple as searching for the lowest published 5 year fixed rate, you could go to a loan comparison web site and just look it up. The reality is it is more complex than that, and other factors come into play. For example, discounts which are not published for large loans, and discounts on loans taken in conjunction with a professional package. And don’t forget the all the fees and charges often associated with fixed rate loans. At Mortgage Experts, we are familiar with a wide range of lenders and know their real pricing, their policies and their procedures, so we can find you the most cost effective 5 year fixed rate.

Stop the press - 5 year fixed rates slashed!

Please contact us for a quote. Rates start from 4.94% (current as at November 2014).

5 year fixed rate loans with the flexibility to pay extra off your loan and have an offset account?

Yes! They are available from a small group of lenders. One of the main drawbacks of traditional fixed rate loans is their inflexibility with most 5 year fixed rate loans on the market only allowing limited extra repayments if any at all and most definitely not having an offset account.

Other lenders tricks with 5 year fixed rate loans - don't forget the rate lock!

So you are ready to take a 5 year fixed rate loan and you ring your bank and they tell you the 5 year fixed rate is say 5.0% pa, you think OK that sounds good I will go with that. You then get your paperwork in order and exchange contracts on your property and wait for settlement which is another few weeks away. Then comes the nasty surprise....you get your first statement after settlement and the rate you are locked into for the next 5 years is 0.5% higher than the rate you applied for. How can this be? Well your lenders rate went up between when you applied and when you settled. Your lender informs you sorry it is on the day of settlement that your 5 year fixed rate loan is set. Not happy? Well you have a right not to be.

Most lenders especially the majors only lock in your fixed rate on the day of settlement of your loan. So you have no idea what rate you will actually end up with and you just have to hope they don't put up their rates too much before you settle. Not great is it? Most lenders do give you the option to pay a fee to "rate lock" your 5 year fixed rate loan. However the policies of when a rate can be locked in and how much it costs vary from lender to lender. So it pays to contact us first to talk it through.

We also have access to a few lenders who will either lock in your 5 year fixed rate on the day you submit your application for no fee or will allow you to use a rate that you were quoted up to a couple of weeks before applying (very generous really).

In a rising interest rate market you really should talk with a lending expert if you are considering a 5 year fixed rate loan. Call us or enquire online.

Will I save money over time if I take a 5 year fixed rate loan?

Over the last 20 years you would have been better off on average with a variable rate loan. Over that period however interest rates have trended down though so in the future taking a 5 year fixed rate loan might be a master stroke! What a 5 year fixed rate will definitely give you is certainty as your minimum repayments will not change over the term of the fixed rate.

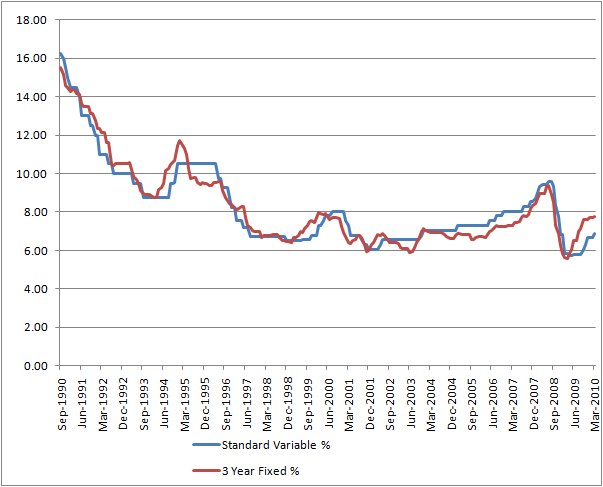

The graph below compares 3 year fixed rates to variable rates over the last 20 years, the 5 year fixed rate trend has been similar. The main difference is 5 year fixed rates have traditionally been around 0.3% pa - 0.5% pa higher then the shorter fixed rate terms.

Source: courtesy of the Reserve Bank of Australia

When not to take a 5 year fixed rate

Basically the answer here is when there is any chance you may need to exit the loan during the 5 year fixed rate term. Especially if there is chance you may need to get out of the loan in the earlier years. Break costs can be significant as per our example below.

Break Cost Example:

Robert borrows $500,000 and elects to take a 5 year fixed rate with interest only repayments. At the time of taking out the loan wholesale interest rates are 4.5% pa.

3 years later Robert has to sell his house, and then he repays his loan in full. The wholesale money market rates at the time he pays out his loan are 3% pa.

Break cost = (loan amount outstanding) x (wholesale rate change) x (term remaining on loan)

Break cost = ($500,000) x (1.5%) x (2)

Break cost = $15,000!

Disclaimer: Please note this is just an example and every lender calculates their break cost differently. In the above example different lenders break costs could be significantly more or less the estimate quoted.

Who should consider taking a 5 year fixed rate?

Fixing your home loan or investment loan for 5 years should be considered only by people who are confident that their situation is not going to change for the worse over the fixed period. 5 year fixed rates are the most popular with conservative borrowers and experienced investors.

If you are planning to buy the house you want to live in for years and years or the investment property you plan to hold until retirement then you should definitely consider a 5 year fixed rate loan. While the interest rates for 5 year fixed rate loans are normally about 0.75% pa higher than competitive variable rate loans this in the greater scheme of things can be a small price to pay for the certainty a 5 year fixed rate loan can provide.

Everybody's situation is unique so it pays to have this conversation with an expert, the decision at the end of the day is always the borrowers but at least we at Mortgage Experts can provide the information you require to make an informed decision.

Want an indicative % for a 5 year fixed rate loan?

Please go to our dedicated current mortgage rates page for more information on current 5 year fixed rate loans.

Want to talk to an expert about the pros and cons of a 5 year fixed rate loan?

Our Current Lender Panel