In particular we focus on getting the loan structure right the first time, choosing which lenders to use in the right order (yes this is important) and finally getting our clients the best deal possible.

Offset Home Loan & Mortgage Offset Accounts

What is an offset home loan?

An offset home loan, a mortgage offset account, an offset account or an interest offset account are all interchangeable phrases. Essentially they are all terms used to describe a home or investment loan that has an interest offset account linked to it.

What is an interest offset account?

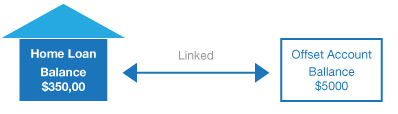

An interest offset account is a transaction account that is linked to a home or investment loan. Most offset home loan accounts these days offset all of the funds in the offset account against the linked loan. Perhaps the best way to explain it is with a diagram as per below.

In this example the loan balance of $350,000 is offset by the balance of the offset account which is $5000. So in this scenario when the daily interest is calculated by the lender on the home loan the interest will be calculated based on a net balance of $345,000.

Another way to think about an offset home loan is to think of the offset account as a transaction account within your home or investment loan. Having funds in the offset account or paying those funds into your loan itself has the same effect on the interest you are charged. Having the funds in the offset account however allows you to use the funds like you would with a normal bank account.

Are mortgage offset accounts a good idea?

Firstly a mortgage offset account is a savings product not a loan product so we are not allowed to advise you whether they are a good idea for you or not (as they fall under the investment advice umbrella), however we can explain how they work so you can make an informed decision.

In our opinion an offset home loan is very useful for almost all investing strategies or loan structures as we will detail below. If the purpose of the offset account is just to save a bit of interest and you have no intention in ever investing then by all means weigh up the cost of having the account over a more no frills product.

Some useful mortgage offset account strategies

Diverting all income to the offset account

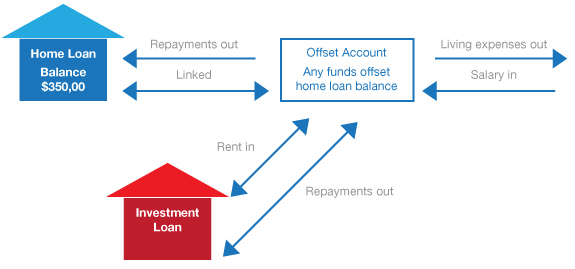

A mortgage offset account can be used as an all in one account to manage your cash flow. If you have an investment loan and a home loan you could direct your salary as well as any rental income into the offset account linked to your home loan which would give you the advantage of having both income sources contribute to offsetting your home loan.

Using a credit card for living expenses and an offset account

Some people also swear by putting all their living expenses on a credit card for the month so that the offset account balance remains as high as possible for most of the month. They then clear their credit card debt once a month from the offset account funds. Some lenders have an automatic sweep function to allow this to be done automatically. By doing this your salary and other income sitting in the mortgage offset account works for you to reduce your interest bill for the month. When you make your regular principle and interest repayment more of the payment then goes towards paying the principle (as you have saved a bit of interest).

Owner occupied property to become investment property

Many first time buyers purchase properties with the intention to turn them into investment properties in the future when they upgrade to a larger or better property. In their circumstances an effective structure would be to use an interest-only loan with a linked mortgage offset account.

The strategy would be to funnel any repayments above the minimum required on the interest-only loan into the offset account. This would do three things:

- Having funds accumulating in a mortgage offset account would effectively mean that the borrower would not pay any extra interest on the loan. This is as compared to a standard principle and interest loan, and provided they paid at least the difference between the interest only and the principle and interest repayments into the offset account each month.

- In the future when the property becomes an investment, they would have a loan for the same amount as initially borrowed and on which the interest charged would be fully tax deductible. This is opposed to if they had made repayments off the principal of the loan. This would then mean the loan balance and therefore interest claimable would be less.

- Any funds accumulated in the mortgage offset account could at that point be used towards the next purchase.

In summary, this structure works for the borrower as they have not be penalised by paying any more interest on their loan than they would have if taking a more traditional loan. And they have maximised their future tax deductibility for when their property becomes an investment.

Offset account versus a loan with redraw (or a line of credit), which is best?

We discuss some tax related consideration below however we are not qualified accountants. Seek your own qualified advice before relying on this or any other information on our website. After many years assisting investors clients this is our understanding of these matters.

Both products are all useful in managing your finances and potentially reducing the interest payable on your loans. However there are very big differences between how they operate at the tax level and investors and potential investors need to wary of a few traps (outlined below). By way of definition the difference between a true offset account and the other two loan types are that an offset account is a separate transaction account and not part of the loan account itself.

- Offset account versus a loan with redraw (or line of credit) - where to put surplus funds?

Once the loan is set up there is no reason to pay any surplus funds you may be lucky to have into the loan itself when you can put those same funds in an offset account instead. I know this seems counter intuitive as traditionally the advice was to pay down your home loan as soon as possible.

Paying extra into the loan or having in an offset account is mathematically the same thing. However by paying funds into the loan you are possibly permanently reducing the interest that can be claimed on the loan. Once any principle of the loan is paid back any subsequent redraw from the loan will be treated as new borrowings and the purpose of the new borrowing will determine whether that part of the loans interest is tax deductible or not.This is very different to an offset account where any funds taken from the offset account have no baring on the loan principle owing and thus has no baring on the tax deductibility of the loan interest going forward. So if you have the flexibility that comes with the interest offset account there is no reason to pay off your home loan.

The classic example is the first home purchase outlined above but the key is the offset account gives the flexibility to not regret a strategy in the future.

- Offset account versus a loan with redraw (or line of credit) - when borrowing for a deposit

If you borrow against equity you have in one property to fund the deposit and costs on a second property purchased for investment purposes (a common strategy to avoid cross collateralisation) you need to be careful about parking the deposit loan proceeds in an offset account while you locate the investment property to purchase. This common strategy is used so you don't have to pay interest on the deposit loan until the funds are actually used and so that funds are easily accessible in the offset account and ready to go when needed. While on the surface that seems totally reasonable it may not be in the eyes of the tax man. If the funds are left too long sitting in the offset account (how long is conjecture) and possibly mixed with other funds before you use them, the tax deductability of the interest on this deposit loan may be lost.

For example say you wanted to set up a loan for the deposit on an investment purchase straight away so you were ready to go when you found the right investment property to buy however you ended up taking 2 years to actually find somewhere suitable. You then use the funds in the offset account as planned and proceeded to claim the interest charged on the loan taken out 2 years ago. In the 2 years you have had your pay going into the account and of course funds going out for expenses. The link or nexus between the original purpose of the deposit loan and the end use could be lost in the eyes of the tax man in this case. It is after all the purpose of the original loan that determines whether the interests is tax deductible or not and in this case it could be argued that the purposes was muddied by time and the fact that funds were mixed in the offset account with everyday (no investment use) monies. So if you borrow and then don't use the loan proceeds to acquire an investment almost immediately then there can be problems identifying if the loan is actually tax deductible at all.

The solution for this possible trap is simple, make sure you use a lender who has both the offset account and redraw capability on the loan itself. That way you can park the funds in the dedicated offset account if you need to access them immediately or if not you can leave them in the loan as redraw to be be drawn when you need them (similar to a line of credit). For loans that are fully drawn at settlement you would pay the loan proceeds back into the loan itself after settlement.

Calculating whether an offset home loan will save you money

If you want calculate if an offset home loan is going to save you enough money to cover the annual fee that usually comes with them you will need to know how much money will be in your offset account on average every day over a year.

For example if the interest rate on a loan is say 7.00% pa and the annual fee is $350 pa then $5000 would be required in the offset account each day on average to cover the annual fees. $350 annual fee / 7% pa = $5000. The higher interest rates are in general the fewer funds are needed in the offset account to cover the fees that normally come with them.

BUT as we have been trying to outline this misses the point to some degree. If you borrowed $600,000 to buy your first home now and in 10 years time you had managed to pay the balance of your loan down to $200,000 rather than parking that same $400,000 of principle into an offset account you would have missed the opportunity to claim interest on the additional $400,000 in the future if you decided to rent out the property. That is a potential tax deduction of around $28,000 pa at average interest rates over the last few years. If your marginal rate of tax was 42 cents in the dollar then that is close to $12,000 pa in tax savings you would have missed out on every subsequent year you held the original property.

All you need to know about mortgage offset accounts – Mortgage Experts

Our Current Lender Panel